Mobile payment

HCE

Introduction

Payment methods are evolving to become more and more convenient for cardholders from aspect of usability, availability and simplicity. One rather new concept introduces the usage of Mobile devices as a replacement for plastic payment cards owned by cardholders.

Most recent MasterCard’s and VISA’s efforts brought out “Cloud based payments” specifications which elaborate a concept where keys are stored in the cloud and no physical equipment in the mobile device is required. Asseco HCE Solution implements the mentioned specifications and provides our clients with a certified full scope HCE solution

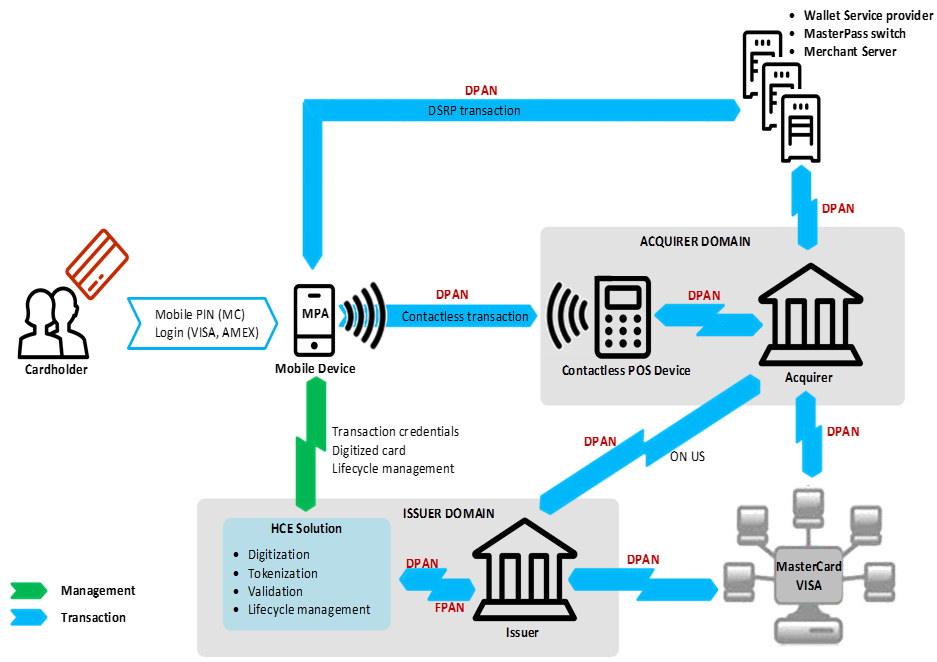

Once the cardholder requests payment in the store, payment is performed simply by entering PIN to the Mobile payment application and by tapping a mobile device to the contactless POS reader terminal. CBP also specifies “In-app” payments by single click using a mobile application (DSRP protocol).

Contactless In store payment

Contactless In store payment

HCE Cloud based payments (CBP)

Cloud based payments stands for

- Storing surrogate (virtual) credit cards in the mobile device

- Making contactless or digital secure remote payments with a mobile device

CBP participants:

- Merchant – Business entity offering goods and services in physical stores or via online shops

- Cardholder – Private or Legal person having agreement with one or more Issuers for using one or more payment cards for payments

- Issuer – FI (Cardholder’s Bank) that issued a payment card, provides either in-house or hosted CBP solution to its cardholders

- Acquirer – FI (Merchant’s Bank) that processes payment

HCE Cloud Based Payments Benefits

Benefits for Issuers:

- Providing new attractive and independent payment services to clients

- Advertising and communicating through mobile payment application

- Using behavior analysis to push marketing promotions in the real time

- No additional authentication methods required

Benefits for Cardholders:

- Alternative and trendy way of exploiting payment cards

- Simple use of mobile devices for payments

- No need for carrying plastic cards

- Offline payments available

Benefits for Merchants:

- Increased usability of Payment cards

- Increase in sales

- No additional hardware or software installation required

Benefits for Acquirers:

- Liability shift moves towards least EMV compliant party in payment chain

- Providing better service to the merchants by providing opportunity to increase sales and decrease disputed transactions

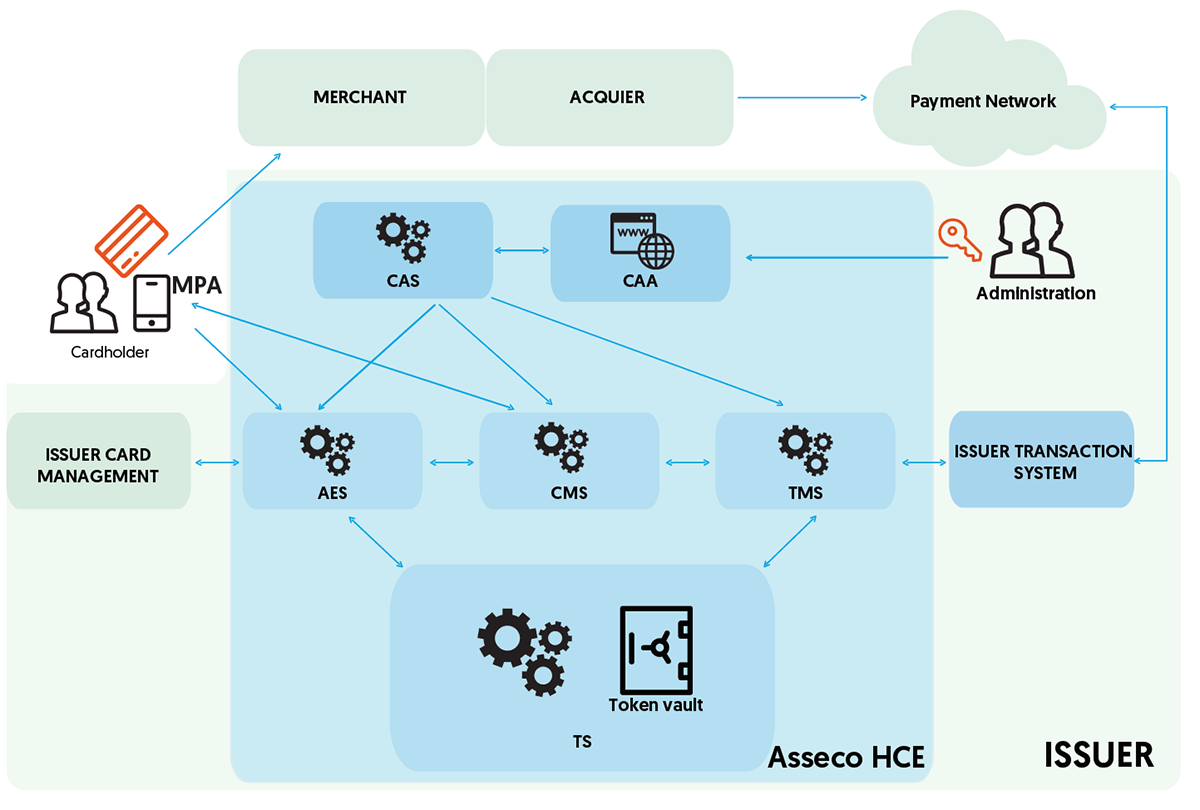

Asseco HCE within Issuer’s environment

Asseco HCE within Issuer’s environment CBP Actors – Asseco HCE Contactless or DSRP transaction

CBP Actors – Asseco HCE Contactless or DSRP transaction